Debt Service Coverage Ratio (DSCR) is a ratio to measure a company's ability to service its short- and long-term debt. It is a measure of how many times a company's operating income can cover its debt obligations.

The ratio is one of the factors used by financial institutions to make credit-related decisions for an entity, and analysts use DSCR to make investment-related decisions.

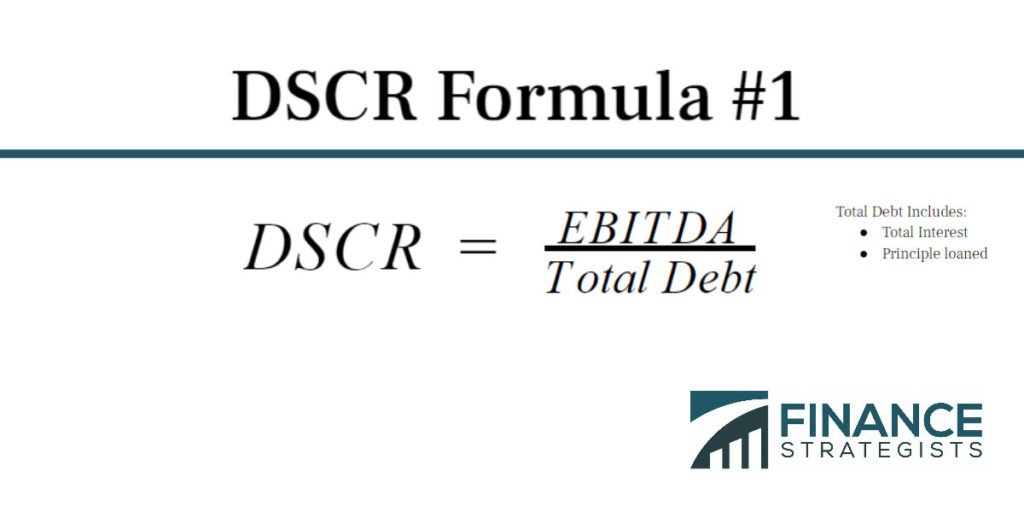

The formula to calculate DSCR is EBITDA divided by total debt (including total interest to be paid and the principal loaned), where EBITDA of a company is the Earnings before Interest, Depreciation, Taxes and Amortization.

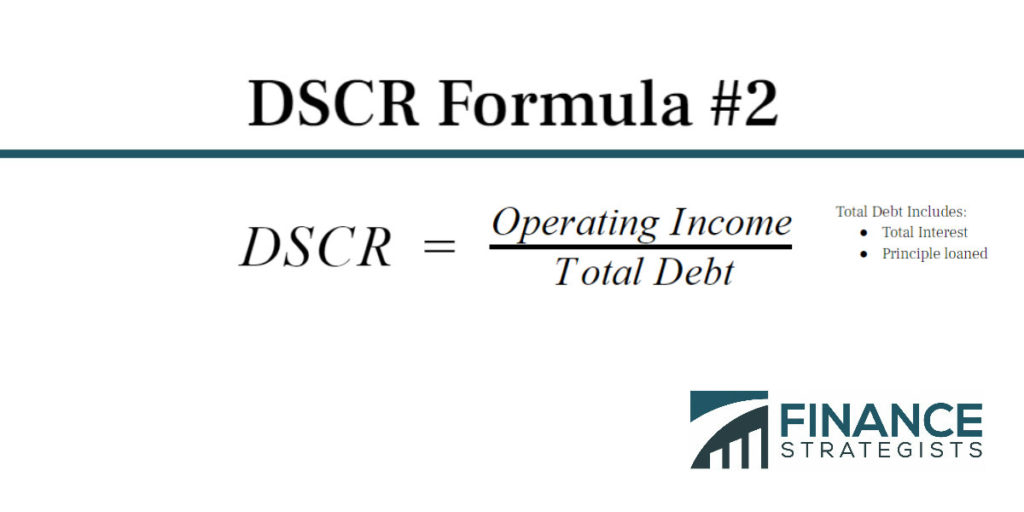

Instead of EBITDA, some investors instead use the formula:

For example, if a company has an operating income of $50,000 and total debt of $25,000 ($10,000 in short-term debt and $15,000 in long-term debt), then it has a DSCR of 2.

A DSCR of 1 or above means that the company has surplus operating income that can be used to service its debts. Conversely, a ratio below 1 is not a good sign because it means that the company is unable to service its current debt commitments.

For example, if a company has a DSCR of 0.5, then it is able to cover only 50% of its total debt commitments.

Companies often employ different strategies to increase their DSCR score.

For example, they might reduce their amount of debt requested, or may reduce their expenses in order to increase their operating income and therefore their DSCR.

Financial institutions use DSCR scores to make credit lending decisions. Entities or individuals with good DSCR scores are generally eligible for loans and receive favorable terms compared to those with bad DSCR scores.

Conditions in the broader economy, such as interest rates, can affect a lender's willingness to extend credit.

For example, lenders relaxed their minimum DSCR score requirements in the years leading up to the financial crisis of 2008. As a result, borrowers with low debt ratio scores had easier access to funds.

It is important to note that Debt Service Coverage Ratios provide less information when viewed in isolation. The debt service ratio of a company should always be measured relative to that of its peers in an industry.

Debt Service Coverage Ratio (DSCR) is a ratio to measure a company’s ability to service its short and long-term debt.

The ratio is one of the factors used by financial institutions to make credit-related decisions for an entity. Analysts use DSCR to make investment-related decisions.

The formula to calculate DSCR is EBITDA divided by total debt (including total interest to be paid and the principal loaned), where EBITDA of a company is the Earnings before Interest, Depreciation, Taxes and Amortization.

A DSCR of 1 or above means that the company has surplus operating income that can be used to service its debts. A ratio below 1 means that the company is unable to service its current debt commitments.

Entities or individuals with good DSCR scores are generally eligible for loans and receive favorable terms compared to those with bad DSCR scores.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.